With the world going online now there is no dearth of online payment gateways. People have readily accepted the online medium to carry out their shopping and banking activities. It has shown some significant growth in online monetary transactions.

In 1998, PayPal started as Cofinity Inc which was founded by Ken Howery, Luke Nosek, Max Levchin, Peter Thiel, and Elon Musk. In the first couple of years, PayPal saw great success growing almost 10% daily even when charging $5-$20 to sign up. By March of 2000, PayPal hit 1 million users and by the Summer of that same year, they had reached 5 million users.

From 2000 to 2002 PayPal partnered with eBay and then was purchased by eBay for $1.5 billion. In 2014, PayPal has officially split from eBay which leads to a $49 billion market value jump. The company just kept growing from there. Continuing to grow in revenue, market share, and users. As well as acquiring multiple companies, such as Venmo, Braintree, VeriSign and more.

Images Sources: chargeback.com

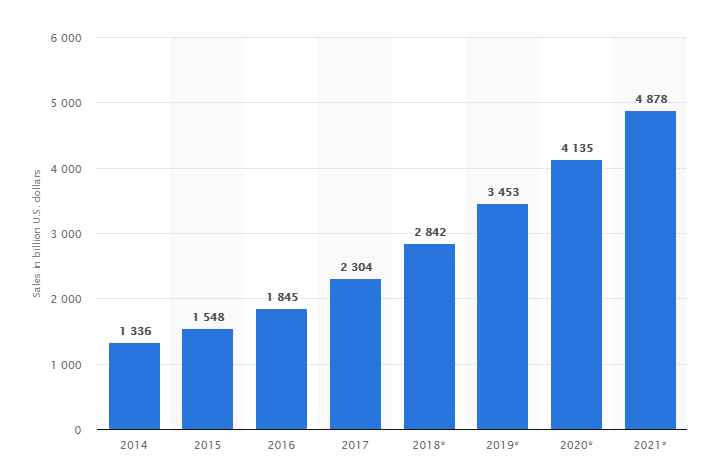

Talking about the holistic business transaction on retail e-commerce sales worldwide from 2014 to 2021. In 2017, retail e-commerce sales worldwide amounted to 2.3 trillion US dollars and e-retail revenues are projected to grow to 4.88 trillion US dollars in 2021. The top 3 online stores’ revenue amounted to almost 100 billion US dollars in 2017. Online shopping is one of the most popular online activities worldwide but the usage varies by region – in 2016, an estimated 19 percent of all retail sales in China occurred via the internet but in Japan, the share was only 6.7 percent.

Images Source: Statista.com

The entire credit for this success goes to the reliable operating methodology of a payment gateway alongside the online and mobile app developers that comply with PCI Data Security Standards. It ensures that payment procedures are performing safely and rapidly.

Therefore, it’s necessary to take a position some analytical thoughts once it involves selecting the integrated payment gateway.

Not only this but hiring the best app development companies can solve the problem by integrating payment gateways even with mobile apps. the reason being, desegregation correct payment gateway makes it straightforward for customers to pay for the products or services via the online or mobile app. Here should a few things vendors be bear in mind while selecting the payment gateway.

1. Security

The uppermost priority while selecting the payment gateway should be payment security. With the arrival of online transactions, there’s additionally a major increase in the numbers of Mastercard frauds and dummy transactions. The Payment Card business information Security ensures that customers’ virtual cash information is collected and held on firmly, thereby reducing the protection risks associated with the web trades.

It may be always higher to not assume that the payment entree is PCI compliant. as a result of yielding with these standards aren’t solely the merchant’s responsibility as your business is additionally involved an equivalent. it’s continually sensible to confirm that your security needs are attainable to satisfy, and the best is to inquire concerning the compliance encompassing them.

One of the most important facets to think about is that the methodology of capturing Mastercard information that involves selecting from the iframe, hosted, or API. Also, it’s best to understand concerning the data safe-keeping protocols followed by the selected methodologies.

2. Selecting The Kind of Gateway: Classic V/S Modern

The basic distinction between the Classic and trendy entree is the merchandiser account. Classic entree needs the merchandiser account whereas the trendy gateway does not want the same because the same is seamlessly inset with the checking account. to ensure that payment entree remains in harmony with the online and mobile app one needs to hire top app developers Atlanta can understand your requirements exactly.

1. Classic Payment Gateway

Opt for the Classic entree if you’re able to tackle some hassles and run a bigger store. A classic entree is best for a business that operates on a bigger scale with a high quantity of daily transactions. However, there are lots of hassles in deploying the Classic entree.

Apart from taking a lot of time to line up, it additionally needs some quantity of technical data as a result of an equivalent has to be integrated with API and needs a merchandiser account. one of the largest advantages of the Classic entree is that the lesser quantity of the per-transaction fee compared to the trendy ones. A few well-liked samples of the Classic entree are Authorize.Net, WorldPay, and 2 Checkout.

2. Modern Payment Gateways

One of the largest benefits of contemporary Payment gateways is that you just don’t need a merchandiser account, and it’s relatively straightforward to line up. However, at an equivalent time, the per-transaction rates are comparatively a lot. Another disadvantage is that it redirects customers to the payment website which might hamper the conversion ratios. a number of the favored samples of trendy entree includes PayPal, Stripe, and SimplifyCommerce.

3. Transparency

The online payment business has witnessed some important modifications within commercialism for the past five years. yet, traditionally speaking, the business is jam-packed with corporations activity the fees and protect you on a long-run basis.

Of late, there’s one issue that everybody during this business is searching for – transparency. Transparency is currently the first concern for companies coping with virtual cash and online transactions.

The best thanks to gauging the service supplier are by its clear and easy rating arrange. it’s of utmost importance that transparency is maintained throughout the dealing, permitting you to depart or choose for a special supplier at any purpose of your time by property you are taking the MasterCard information with you. There are a few of the seller

United Nations agency offers the services of knowledge movableness.

4. Choosing the Best-suited Hosting Methodology

Regarding hosting the payment gateways, there are 2 choices. One is that the off-site or a hosted methodology, and therefore the different is an integrated entree.

1. Hosted Payment Gateways

People at home with PayPal should already remember the hosted payment entree that redirects the purchasers to the payment processor’s platform wherever users provide out all the payment data. One of the simplest rewards of the hosted payment entree comes within the sort of investing responsibility because the offsite supplier is alone chargeable for the PCI compliance and information security.

On the drawback, in some countries, these offsite payment processors aren’t trustworthy whereas on the opposite hand in some they’re a lot of most popular. That the best means is to determine the user’s perception of however they understand a hosted entree. Moreover, also, amusive the users to a different website isn’t an honest plan, particularly if they assume that the actual entree isn’t trustworthy.

2. Integrated Payment Gateway

The integrated gateway connects the eCommerce website with the gateway’s pre-delivered API. The disadvantage of the customer going off-site in hosted gateway turns the same into a bonus as they ne’er go off-site for the payment purpose. In all, it offers smooth and seamless expertise to customers.

Even the integrated entree has its limitation in the sort of ability needed to integrate the chosen entree. Many eCommerce platforms may smoothly incorporate a wide range of gateways with the assistance of assorted APIs. However, there is one protocol up here, selecting those that do not support “out of the box” might need some custom programming for its economic functioning.

Moreover, the rating issue ought to even be thought of whereas selecting the payment entree. it’s necessary to determine the exploit sales because it will affect the companies dealing in a luxury product. it’s always higher to hover upon the necessity and capability multiple times before deciding the payment entree for the business giving websites.